Background

The City of Courtenay is developing an Amenity Cost Charge (ACC) Bylaw, a new tool that will help fund community amenities needed to support Courtenay’s continued growth.

ACCs were introduced through Bill 46 (2023) as part of the Province’s changes to the Local Government Act. They allow municipalities to collect funds from new development for amenities that serve the broader community.

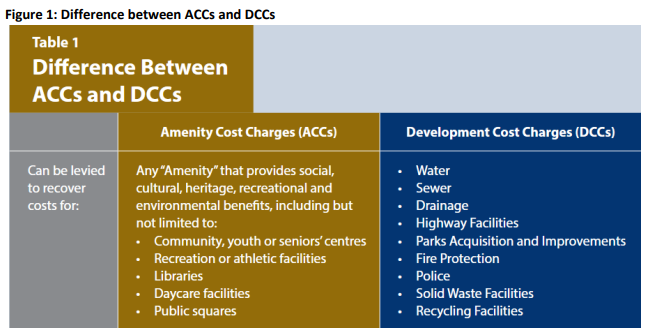

While Development Cost Charges (DCCs) fund essential infrastructure such as water, sewer, drainage, roads, and parks, ACCs focus on community amenities that improve livability and social well-being, including:

- Recreation and cultural facilities

- Parks, trails, and open spaces

- Sportsfields and playgrounds

- Dog parks and spray parks

- Cultural and community centres

Together, DCCs and ACCs ensure that growth pays for growth; balancing the costs of new infrastructure between the development community and existing taxpayers.

Where we are now

The City is continuing work toward adopting an Amenity Cost Charge (ACC) Bylaw.

In December 2025, staff presented a report to Council outlining ACC rate options, including potential rates for institutional and industrial development. The report also provided an opportunity for Council to review the draft ACC project list, which identifies the types of community amenities that could be funded through ACCs.

This discussion helped inform the development of the proposed ACC Bylaw and the projects that may be included as part of the program.

ACC rates and the associated project list will continue to be refined as the bylaw moves through the Council review and adoption process.

Additional information and updates will be shared as the bylaw progresses.

Proposed ACC rates

| Land Use | Unit | Proposed Rate (2025) |

|---|---|---|

| Low Density Residential | per lot or dwelling unit | $ 6,643 |

| Medium Density Residential | per unit | $ 3,618 |

| High Density Residential | per m² GFA | $ 42.56 |

| Commercial | per m² GFA | $ 13.84 |

| Industrial / Institutional | — | Exempt |

Rates include a 1 % Municipal Assist Factor (MAF) and are based on Courtenay’s 20-year growth projections.

Over this period, the program could collect up to $26 million of the estimated $73 million in growth-related amenity costs.

Proposed projects

The draft ACC program funds the following amenities to support growth over the next 20 years:

- Community Centre Expansion

- Florence Filberg Centre Expansion

- Outdoor Pool Expansion

- Sportsfield Improvements

- Pickleball Court Construction and Improvements

- Dog Park Construction and Improvements

- Cultural Facility Expansion

- LINC Youth Centre and Skateboard Park Improvements

- Spray Park Construction

- Park Amenity Program

All projects were reviewed for eligibility under the Local Government Act and the ACC Best Practices Guide, ensuring they directly serve the needs of Courtenay’s growing population.

Economic analysis

To evaluate how ACCs may impact development, the City retained City Squared Consulting to conduct a financial feasibility study.

The analysis confirmed that:

- The proposed rates are modest and viable under current economic conditions.

- Phasing in rates is not required.

- Increased density anticipated through the Official Community Plan (OCP) and Zoning Bylaw updates will help offset development costs.

Learn more:

Amenity Cost Charges (ACCs) are one-time fees collected from new development to help pay for community amenities such as recreation centres, trails, and cultural facilities.

They ensure that new growth contributes to the amenities that make Courtenay a great place to live.

ACC rates are based on:

- 20-year growth projections

- Eligible capital projects (e.g., recreation and culture facilities)

- Benefit allocation between existing and new residents

- A Municipal Assist Factor (MAF), which determines the City’s share of costs

The City’s current proposal uses a 1% MAF and modest, city-wide rates for residential and commercial uses.

- DCCs fund essential infrastructure like water, sewer, drainage, roads, and parks.

- ACCs fund community amenities like recreation centres, sportsfields, and cultural spaces.

Together, they ensure growth pays for both infrastructure and quality-of-life amenities.

ACCs are typically collected:

- At subdivision approval for low-density residential development, or

- At building permit issuance for other residential and commercial developments.

This ensures the City can fund and deliver new amenities as development occurs.

Yes. Under the Local Government Act, ACCs do not apply to:

- Affordable and government or non-profit owned or leased rental housing

- Supportive, cooperative, or transitional housing

- Places of public worship

- Developments that do not increase population or employment

- Any capital cost already covered by a DCC

The MAF is Council’s policy decision on how much the City contributes toward growth-related amenities.

The provincial minimum is 1%, but Councils may choose to contribute more.

A higher MAF lowers costs for new development but increases the City’s financial responsibility.

Following consultation in fall 2025, staff will present the final ACC Bylaw for Council’s consideration.

Unlike DCC bylaws, ACC bylaws do not require Provincial Inspector approval between third and fourth reading, allowing both the ACC and DCC bylaws to be adopted together later this year.